3 Questions You May Be Asking About Selling Your House Today

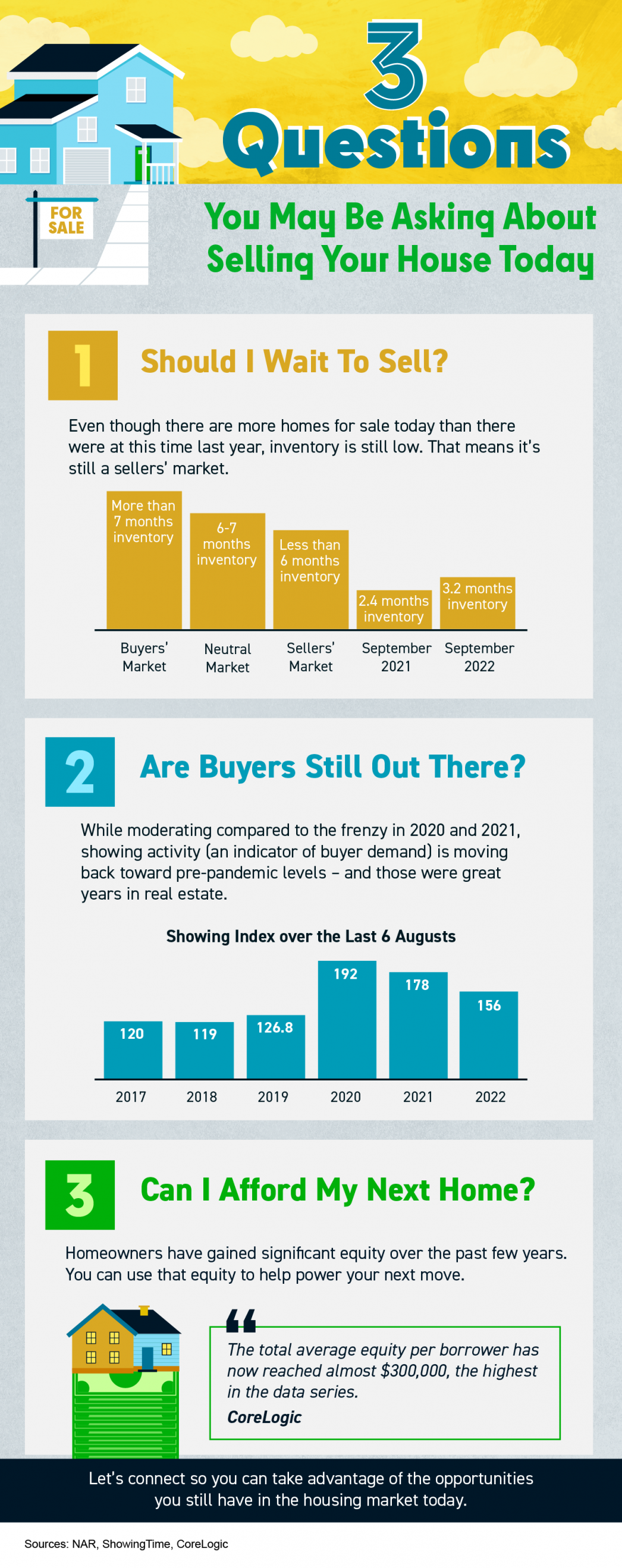

3 Questions You May Be Asking About Selling Your House Today [INFOGRAPHIC] Some Highlights If you’re planning to sell your house this year, you likely have questions about what the shift in the housing market means for your home sale. You might be wondering: Should I wait to sell? Are buyers still out there? And can I afford to buy my next home? Let’s connect so you can get answers to these questions and learn about the opportunities you still have in today’s housing market.

Read More

Four Things That Help Determine Your Mortgage Rate

Four Things That Help Determine Your Mortgage Rate If you’re looking to buy a home, you probably want to secure the lowest interest rate possible for your home loan. Over the last couple of years, that was easier to do as the housing market saw record-low mortgage rates, but this year rates have risen dramatically. If you’re looking for ways to combat today’s higher rates and lock in the lowest one you can, here are a few factors to focus on. Since approval opportunities can vary, connect with a trusted lender for customized advice. Your Credit Score Credit scores can play a big role in your mortgage rate. Freddie Mac explains: “When you build and maintain strong credit, mortgage lenders have greater confidence when qualifying you for a mortgage because they see that you’ve paid back your loans as agreed and used your credit wisely. Strong credit also means your lender is more apt to approve you for a mortgage that has more favorable terms and a lower interest rate.” That’s why it’s important to maintain a good credit score. If you want to focus on improving your score, your trusted advisor can give you expert advice to help. Your Loan Type There are many types of loans, each offering different terms for qualified buyers. The Consumer Financial Protection Bureau (CFPB) says: “There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose.” When working with your real estate advisor, make sure you find out what’s available in your area and which types of loans you may qualify for. Your Loan Term Another factor to consider is the term of your loan. Just like with location and loan types, you have options. Freddie Mac says: “When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.” Depending on your situation, the length of your loan can also change your mortgage rate. Your Down Payment If you’re a current homeowner looking to sell and make a move, you can use the home equity you’ve built over time toward the down payment on your next home. The CFPB explains: “In general, a larger down payment means a lower interest rate, because lenders see a lower level of risk when you have more stake in the property. So if you can comfortably put 20 percent or more down, do it—you’ll usually get a lower interest rate.” To learn more, connect with a lender to find out the difference a higher down payment can make for your new mortgage. Bottom Line These are just few factors that can help determine your mortgage rate if you’re buying a home. The best thing you can do is have a team of professionals on your side. Connect with a local real estate professional and a trusted lender so you have the expert advice you need in each step of the process.

Read More

What Are Experts Saying About the Fall Housing Market?

What Are Experts Saying About the Fall Housing Market? The housing market is rapidly changing from the peak frenzy it saw over the past two years. That means you probably have questions about what your best move is if you’re thinking of buying or selling this fall. To help you make a confident decision, lean on the professionals for insights. Here are a few things experts are saying about the fall housing market. Expert Quotes for Fall Homebuyers A recent article from realtor.com: “This fall, a more moderate pace of home selling, more listings to choose from, and softening price growth will provide some breathing room for buyers searching for a home during what is typically the best time to buy a home.” Michael Lane, VP and General Manager, ShowingTime: “Buyers will continue to see less competition for homes and have more time to tour homes they like and consider their options.” Expert Quotes for Fall Sellers Selma Hepp, Interim Lead of the Office of the Chief Economist, CoreLogic: “. . . record equity continues to provide fuel for housing demand, particularly if households are relocating to more affordable areas.” Danielle Hale, Chief Economist, realtor.com: “For homeowners deciding whether to make a move this year, remember that listing prices – while lower than a few months ago – remain higher than in prior years, so you're still likely to find opportunities to cash-in on record-high levels of equity, particularly if you've owned your home for a longer period of time.” Bottom Line Mortgage rates, home prices, and the supply of homes for sale are top of mind for buyers and sellers today. And if you want the latest information for our area, let’s connect today.

Read More

What a $1M Home Looks Like In All 32 Pro Football Cities

What a $1M Home Looks Like In All 32 Pro Football Cities Football season is upon us and to kick off the fall, we're sharing what a $1 million dollar listing looks like in each of the 32 pro football cities. From Green Bay to L.A (and everywhere between), there are some spectacular homes close to each stadium! 📍 Glendale, Arizona Listed at $1,000,000 Take a Look 📍 Atlanta, Georgia Listed at $1,195,000 Take a Look 📍 Charlotte, North Carolina Listed at $1,179,000 Take a Look 📍 Chicago, Illinois Listed at $1,069,000 Take a Look 📍 Arlington, Texas Listed at $1,100,001 Take a Look 📍 Detroit, Michigan Listed at $1,200,000 Take a Look 📍 Green Bay, Wisconsin Listed at $1,140,000 Take a Look 📍 Inglewood, California Listed at $1,099,000 Take a Look 📍 Minneapolis, Minnesota Listed at $1,050,000 Take a Look 📍 New Orleans, Louisiana Listed at $1,025,000 Take a Look 📍 East Rutherford, New Jersey Listed at $999.990 Take a Look 📍 Philadelphia, Pennsylvania Listed at $1,095,000 Take a Look 📍 Santa Clara, California Listed at $1,098,000 Take a Look 📍 Seattle, Washington Listed at $1,050,000 Take a Look 📍 Tampa Bay, Florida Listed at $1,095,000 Take a Look 📍 Landover, Maryland Listed at $950,000 Take a Look 📍 Baltimore, Maryland Listed at $1,195,000 Take a Look 📍 Orchard Park, New York Listed at $1,075,000 Take a Look 📍 Cincinnati, Ohio Listed at $1,100,000 Take a Look 📍 Cleveland, Ohio Listed at $1,134,000 Take a Look 📍 Denver, Colorado Listed at $1,000,000 Take a Look 📍 Houston, Texas Listed at $1,100,000 Take a Look 📍 Indianapolis, Indiana Listed at $1,050,000 Take a Look 📍 Jacksonville, Florida Listed at $1,200,000 Take a Look 📍 Kansas City, Missouri Listed at $1,085,000 Take a Look 📍 Paradise, Nevada Listed at $1,184,000 Take a Look 📍 Inglewood, California Listed at $1,099,000 Take a Look 📍 Miami Gardens, Florida Listed at $1,050,000 Take a Look 📍 Foxborough, Massachusetts Listed at $979,995 Take a Look 📍 East Rutherford, New Jersey Listed at $1,300,000 Take a Look 📍 Pittsburgh, Pennsylvania Listed at $1,175,000 Take a Look 📍 Nashville, Tennessee Listed at $1,099,000 Take a Look Looking For Your Own Place to Watch the Games? Let's Keep in Touch Tatyana Grigoryan Realtor® 8505911433

Read More

Categories

Recent Posts